Leasing Despite Debt Collection / Betreibung?

It can happen so quickly: Maybe you're short on cash one month or facing challenging life circumstances, and a bill slips through the cracks. Next thing you know, you receive a debt collection notice in the mail.

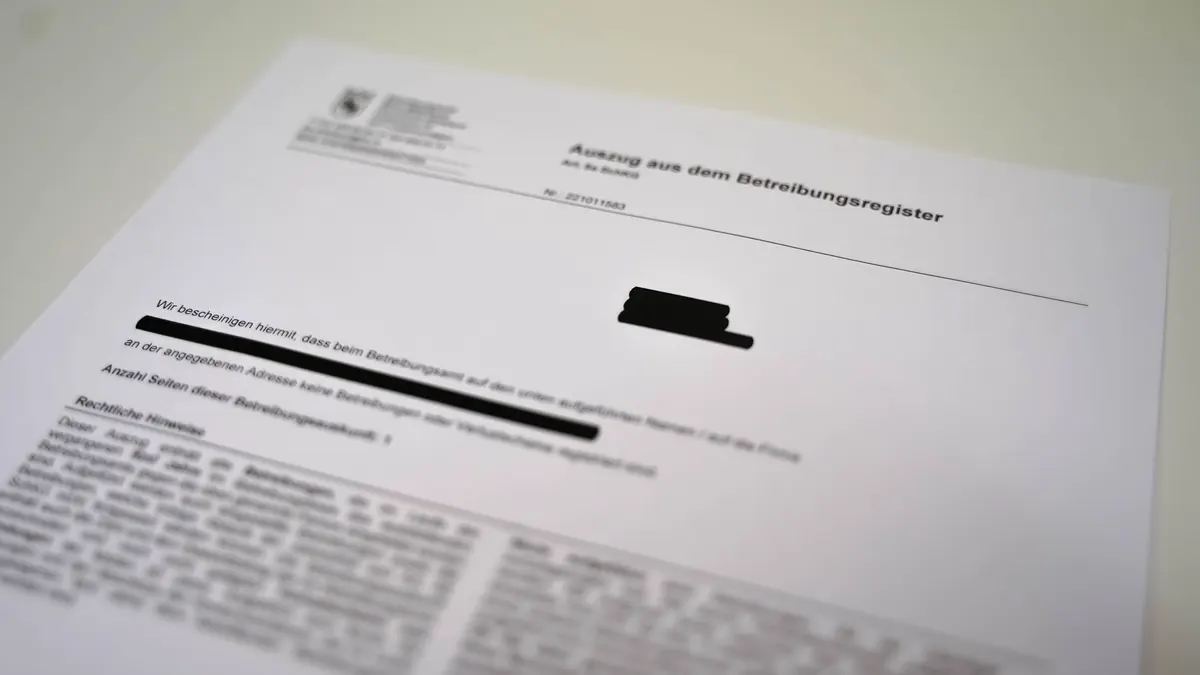

If you have an entry in the debt collection register or are currently subject to debt collection proceedings, you will not be granted a lease. However, having a debt collection on your record doesn't necessarily spell doom for your leasing aspirations. An ongoing debt collection procedure is a no-go for reputable leasing companies and banks. However, settled or unjustified debt collection procedures in the past do not necessarily mean that your leasing dreams are over. Unjustified debt collection procedures can be contested and settled debt collection procedures can be deleted. In this blog article, you will learn everything you need to know about how to clear your debt collection register extract so that you can start leasing with a clean slate.

- Creditworthiness and Leasing in Switzerland

- Terminology

- What is a Debt Collection?

- Initiation of Debt Collection

- Post-Initiation Procedures

- Costs Associated with Debt Collection

- Leasing with a Debt Collection

- Companies Offering Leases with Active Debt Collections

- Securing a Trustworthy Lease Despite a Debt Collection

- Settling the Debt Collection

- Removing the Debt Collection

- Unjustified Debt Collection

- Contesting the Debt Collection

- How Do I Know If I Have a Debt Collection?

- ZEK, CRIF, and Intrum: An Overview and Comparison

- ZEK (Central Office for Credit Information)

- CRIF

- Intrum

- Comparison of the Three Organizations

- Conclusion on Debt Collections and Leasing

Creditworthiness and Leasing in Switzerland

In Switzerland, when you apply for a lease, banks will first assess your creditworthiness. This is primarily for consumer protection, as it's illegal to grant credit that could lead to a consumer's over-indebtedness. Essentially, a credit check ensures that you have the financial capacity for a lease. But there's one thing that can quickly derail your application: an ongoing debt collection. Can you secure a lease with an active debt collection? How can you remove a settled or unjustified debt collection? And what do terms like "CRIF" and "ZEK" mean? This blog post will answer all these questions and more.

Terminology

| Term | Description |

|---|---|

| Debt Collection / “Betreibung” | In Switzerland, a debt collection or “Betreibung” is the legal process used to recover outstanding debts owed by a debtor to a creditor. |

| Debt Collection Register | A place for information about debt collections. A debt collection remains visible in the register for five years, even if it was contested. |

| Creditor | A "creditor" is an individual or institution with a claim against a debtor. |

| Debtor | A "debtor" is an individual or entity financially or contractually obligated to a creditor. |

| Legal Objection | A "legal objection" is a formal means to contest a debt collection in Switzerland. |

| ZEK | The ZEK (Central Office for Credit Information) records creditworthiness information from credit transactions in Switzerland for both individuals and legal entities. |

| CRIF | A credit reporting agency in Switzerland that provides credit-relevant information about individuals and businesses. Individuals can also obtain self-reports here. |

| Intrum | A European debt collection agency offering debt management and payment services for creditors. gowago.ch collaborates with Intrum for the online signature process. |

What is a Debt Collection?

In Switzerland, the process of debt recovery is termed "debt collection." It's a legal tool allowing creditors to claim their outstanding debts from defaulting debtors. The process is structured, transparent, and offers both parties a fair opportunity to present their case. Let's delve deeper into the debt collection procedure.

Initiation of Debt Collection

Switzerland has over 500 jurisdictions where a debt collection can be filed. The first step involves submitting a debt collection request to the relevant debt collection office. This request should include details about the creditor and debtor, including the amount owed or the collateral in Swiss currency. A maximum of 10 claims can be listed. It's crucial to note that no additional documents should be attached, except the basis for the claim.

The debt collection office reviews the request for its formality, not the validity of the claim. This means they don't verify the legitimacy of the debt but only ensure the request was properly filed. Unfortunately, this means unjustified debt collections are a reality in Switzerland - theoretically, anyone can initiate a debt collection against anyone else.

Post-Initiation Procedures

Once the debt collection request is filed, the debt collection office issues a payment order. This is delivered to the debtor, who then has 20 days to settle the debt. If the debtor fails to pay, they can raise a legal objection within 10 days. Such an objection halts the debt collection process unless the creditor can legally enforce their claim.

It's essential to note that an unjustified legal objection can incur significant costs. Therefore, debtors should ensure they have a valid reason for the objection.

Costs Associated with Debt Collection

Typically, the debtor bears the costs of the debt collection process. This includes the fee for a payment order. However, additional costs may arise for delivery attempts and other procedural steps.

Leasing with a Debt Collection

You can apply, but will you be approved? With a reputable, transparent bank, it's unlikely or challenging.

For your protection and the bank's, they must ensure you don't overextend yourself financially. Article 3, Paragraph 1n of the UWG states:

"It's prohibited to grant credit that leads to the over-indebtedness of the consumer."

If a bank knowingly grants you credit (including leases) that pushes you into debt, they're acting unlawfully. Moreover, the bank risks losing their investment if you default on the lease.

Companies Offering Leases with Active Debt Collections

Some companies claim to offer lease contracts for individuals with debt collections. While this might seem tempting at first glance, there are crucial considerations:

- Too Good to Be True: If an offer sounds too good, it probably is. Companies offering leases to those with poor credit might have hidden fees, exorbitant interest rates, and unfavorable contract terms.

- Lack of Transparency: Some of these companies might not be transparent about their offer's conditions. It's vital to scrutinize all contract details and ensure you understand every aspect. In the past, certain companies offered leases with debt collections but only rented out the car.

- Company Reputation: It's advisable to check the company's reputation before signing any contract. Online reviews, customer feedback, and recommendations can provide insights into the company's trustworthiness.

Securing a Trustworthy Lease Despite a Debt Collection

We recommend applying for a lease only if you have a clean financial record, meaning no active debt collections. Having 2-3 settled debt collections on your record might not be a significant issue. However, if there are more, you should address them promptly. Debt collections can hinder not only lease applications but also house hunting, other credit applications, and even job searches. But don't worry, there are ways to address debt collections.

Settling the Debt Collection

The most straightforward method to address a debt collection is to settle the debt. You can pay the entire amount within the specified period in the debt collection notice. Once paid, the debt collection process ends.

However, be cautious: The debt collection isn't automatically removed, even if settled. Without your intervention, it remains on your record for five years, even after payment, legal objection, or if it was unjustified. Only then is the entry automatically removed.

If you settle the debt collection, it's noted in the debt collection register as "debt collection paid to the debt collection office." It's up to the bank to decide if they'll grant you a lease with settled debt collections. 2-3 settled debt collections in the past might be acceptable, but numerous debt collections will likely pose challenges, as trust in your financial capability might be compromised.

Removing the Debt Collection

If you believe the debt collection is unjustified or if you've already settled the debt, you can request its removal.

- Proof of Payment: If you settled the debt before the debt collection was initiated, you can prove this with payment receipts or bank statements. It's possible that your payment and the debt collection notice crossed paths. In such cases, you must contest the debt collection at the debt collection office within 10 days. It's crucial to retain proof of your payments, so always keep your payment receipts and invoices.

- Agreement with the Creditor: In some instances, you can directly negotiate with the creditor and request them to withdraw the debt collection. This is common when misunderstandings or errors occur. The creditor will then process the withdrawal at the debt collection office. But be wary! The creditor isn't obligated to process your removal request.

- Legal Action: You can also contest the debt collection legally. If the court rules in your favor, they'll annul the debt collection. However, be aware that legal proceedings can incur court and attorney fees. In such cases, it's advisable to consult an attorney.

Unjustified Debt Collection

In Switzerland, anyone can initiate a debt collection against anyone else without any prerequisites. This means someone can start a debt collection against another individual without having to prove an actual debt exists. This system can lead to unjustified debt collections.

Characteristics of an Unjustified Debt Collection:

- No Actual Debt: The debtor doesn't owe the creditor any money, or the claim is disputed.

- Lack of Contractual Basis: There's no legal or contractual basis for the claim, such as hidden costs in an ostensibly free online offer.

- System Abuse: Sometimes, creditors exploit the debt collection system to pressure debtors, even when no genuine claim exists.

Protection Against Unjustified Debt Collections:

Since January 1, 2019, Swiss law offers those unjustly subjected to debt collections a tool to clean their debt collection register. They can request the debt collection office not to disclose the unjustified debt collection. This procedure costs a flat fee of 40 Swiss Francs.

Contesting an Unjustified Debt Collection:

- Raise an Objection: Within 10 days of receiving the payment order, the affected individual can file an objection at the debt collection office. This temporarily halts the debt collection process.

- Request Removal: After three months from the payment order's delivery, the affected individual can file a "Request for Non-Disclosure of a Debt Collection to Third Parties" at the debt collection office. Following this procedure, the debt collection isn't removed but won't appear in extracts from the debt collection register.

Contesting the Debt Collection

If you believe the debt collection is unjustified, you can contest it.

- Objection: Within 10 days of receiving the payment order, you can file a written, reasoned objection at the relevant debt collection office.

- Legal Objection: If you wish to contest the debt collection, you can raise a legal objection. This must be done within a specific period after receiving the debt collection notice. The legal objection temporarily halts the debt collection process, and the creditor must then legally enforce their claim.

- Legal Proceedings: If the creditor contests the legal objection, a legal proceeding is initiated. Here, you have the opportunity to present your arguments and evidence. The court then decides whether to continue or annul the debt collection.

How Do I Know If I Have a Debt Collection?

ZEK, CRIF, and Intrum: An Overview and Comparison

In Switzerland, various organizations deal with credit information and debt collection. Three of the most renowned are ZEK, CRIF, and Intrum. In this article, we'll provide an in-depth look at each of these organizations and compare them.

ZEK (Central Office for Credit Information)

Description: The ZEK, also known as the Central Office for Credit Information, is an organization that gathers information about credit obligations of individuals and businesses in Switzerland. It serves as a central hub for lenders to check the creditworthiness of applicants.

Main Tasks:

- Collecting and storing credit information.

- Providing this information to banks and other financial institutions.

- Ensuring the correct and fair use of credit data.

Check out ZEK's website and details here.

CRIF

Description: CRIF is an international company specializing in credit reporting, business information, and credit solutions. In Switzerland, CRIF offers credit checking and rating services. You can also obtain an overview of your creditworthiness from CRIF. Click here to get a self-report.

Main Tasks:

- Creating credit reports for individuals and businesses.

- Assisting businesses in risk assessment and decision-making.

- Offering data analysis and management solutions.

You can also obtain an overview of your creditworthiness from CRIF. Click here to get a self-report.

Intrum

Description: Intrum is a leading European company in Credit Management Services. It offers a wide range of services, from invoicing to debt collection and debt purchasing.

Main Tasks:

- Assisting businesses in invoicing and debt management.

- Conducting debt collection services for unpaid invoices.

- Purchasing debt portfolios from businesses.

gowago.ch collaborates closely with Intrum to simplify the leasing process. For instance, all online signatures for leasing contracts with gowago.ch are processed in conjunction with Intrum.

Comparison of the Three Organizations

- Purpose: While ZEK and CRIF primarily gather and provide credit information, Intrum focuses on debt management and collection.

- Services: ZEK mainly focuses on collecting and providing credit information. CRIF offers a broader range of services, including data analysis and risk assessment. Intrum provides comprehensive services in the realm of debt management.

Conclusion on Debt Collections and Leasing

In Switzerland, the debt collection system is an efficient means of debt recovery. But like any system, there are pitfalls and potential abuses. An unjustified debt collection can have significant negative impacts on an individual's life and creditworthiness. Therefore, it's crucial to be aware of one's rights and responsibilities. Organizations like ZEK, CRIF, and Intrum play a vital role in assessing creditworthiness, and it's essential to understand their functions and differences. If faced with a debt collection, whether justified or not, it's advisable to get informed promptly and, if necessary, seek legal advice. Knowing the various ways to combat, pay, or remove a debt collection is a valuable tool to ensure financial clarity and security in Switzerland.