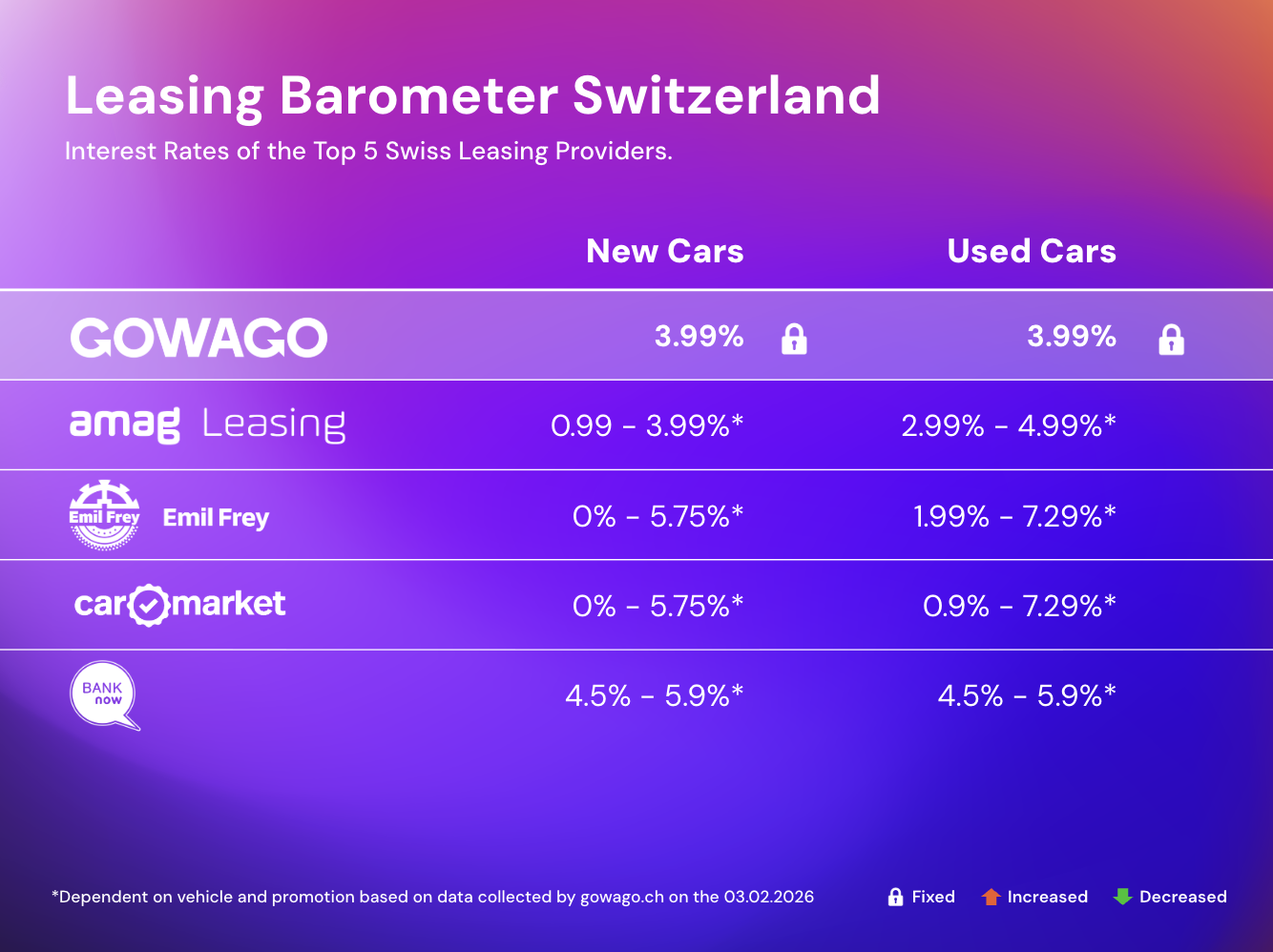

Comparison of Swiss Leasing Interest Rates (Updated for February 2026)

Welcome to the Swiss Leasing Barometer! Once you have decided on financing your car through leasing, the next difficult choice opens up: with which company and at what interest rate?

Crucial for your ultimate decision are, among other things, the various leasing interest rates - especially during a time when interest rates are rising everywhere. In the dense leasing jungle, it is difficult to keep a clear overview anyway - and the various interest rates make this all the more difficult.

To relieve you of this burden, we have developed the Leasing Barometer. This list is updated monthly so that you are always up-to-date!

Observed Nominal interest rates of Swiss leasing providers as of 03.02.2026

| New Cars | Used Cars | |

|---|---|---|

| Gowago Leasing by Migros Bank | 3.99% | 3.99% |

| AMAG Leasing | 0.99% - 3.99%* | 2.99% - 4.99%* |

| BCGE | 3.25% - 3.40% | 4.25% - 4.40% |

| BMW Financial Services | 1.90% - 2.90% | |

| CA Auto Finance | 0.0% - 5.11%** | |

| Cembra | No longer publically accessible | No longer publically accessible |

| Emil Frey | 0% - 5.75%* | 1.99% - 7.29%* |

| Bank Now | 4.5% - 5.9%* | 4.5% - 5.9%* |

| Mercedes Benz Financial Services | 1.9% - 4.49%** | |

| Mobilize (RCI) Finance | 0.0% - 4.99%** | 0.99 - 6.99%** |

| Carmarket (MultiLease) | 0% - 5.75%* | 0.9% - 7.29%* |

*dependent on vehicle and promotion

** effective

Gowago offers a standard interest rate

At Gowago the interest rate always stays the identical. Whether you want a Mercedes, a VW or an Alfa Romeo - the nominal interest rate is fixed at 3.99%. This way, the overview is much easier.

Discover Gowago Leasing Offers

You are welcome to do your own research by simply clicking on "Leasing details" below the leasing rate in the vehicle overview on our website, where you can also view the fixed, individually calculated residual value.

Why do some providers have a wide range of interest rates?

As you can see, the interest rates of other providers are sometimes quite variable. There are several reasons for this. With captive leasing banks, the interest rates usually depend on the vehicle and the promotion associated with it - often this has to do with stock levels or the introduction of new models or equipment.

Likewise, some captive leasing banks offer interest rate reductions in connection with service and insurance packages. Although this is a positive idea for the consumer, it can lead to confusion - the effective interest rate is now hidden behind promotions and additional services. The overview is lost.

With non-captive leasing providers, interest rates can sometimes also vary. Again, this is due to the diversity of vehicles that the consumer can lease. A used car will receive a different interest rate compared to a new car. Customers can only see the applicable interest rate after receiving an official quote from the leasing provider.